<< Back to Forex Strategy List

Forex Gap Strategy

Forex Gap Strategy — is an interesting trading

system that utilizes one of the most disturbing phenomenons of the Forex

market — a weekly gap between the last Friday's close price and the

current Monday's open price. The gap itself takes its origin in the fact that

the interbank currency market continues to react on the fundamental news during

the weekend, opening on Monday at the level with the most liquidity. The offered

strategy is based on the assumption that the gap is a result of speculations and

the excess volatility, thus a position in the opposite direction should probably

become profitable after a few days.

Features

- Regular trading with clear rules.

- No stop-loss hunting or premature hits.

- Statistically proven profit.

- You have to open position at the week's beginning and close it

right before the end.

How to Trade?

- Select a currency pair with a relatively high level of volatility. I

recommend GBP/JPY as it showed the best results during my tests. But other

JPY-based pairs should work too. By the way, it's a good strategy to use on all

major currency pairs at the same time.

- When a new week starts look if there is a gap. A gap should be at least 5

times the average spread for the pair. Otherwise it can't be considered a real

signal.

- If Monday's (or late Sunday's if you trade from North or South America) open

is below the Friday's (or early Saturday if you trade from Oceania or Eastern

Asia) close the gap is negative and you should open a Long position.

- If Monday's open is above the Friday's close the gap is positive and you

should open a Short position.

- Don't set a stop-loss or a take-profit level (it's a rare occasion but

stop-loss isn't recommended in this strategy).

- Right before the end of the weekly trading session (e.g., 5 minutes before

the end) you need to close the position.

Example

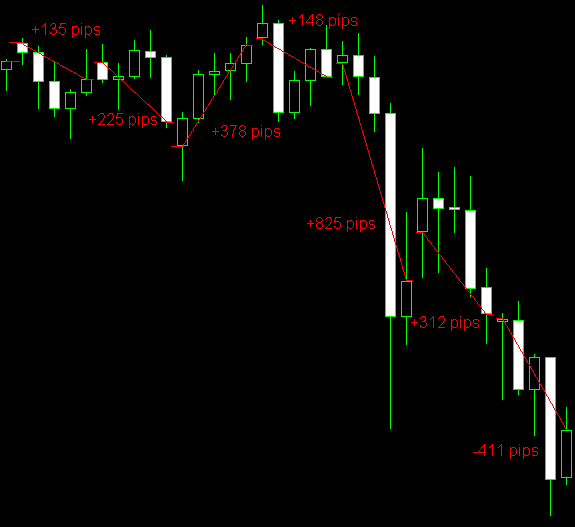

You can see GBP/JPY pair's last 7 weeks (as of May 24, 2010) and all of them

have gaps. 6 out of 7 gaps give correct signals that result in a lot of profit.

The last gap gives a wrong signal and yields a medium loss. The average spread

for GBP/JPY was 3 pips during the example period and all gaps were much wider

than 15 pips, making them all qualifying signals. The net total profit was

1,612 pips in 7 weeks — not that bad.

Warning!

Use this strategy at your own risk. EarnForex.com can't be responsible for

any losses associated with using any strategy presented on the site. It's not

recommended to use this strategy on the real account without testing it on demo

first.

Discussion:

Do you have any suggestions or questions regarding this strategy? You

can always

discuss

Forex Gap Strategy with the fellow Forex traders

on the Trading

Systems and Strategies forum.

|